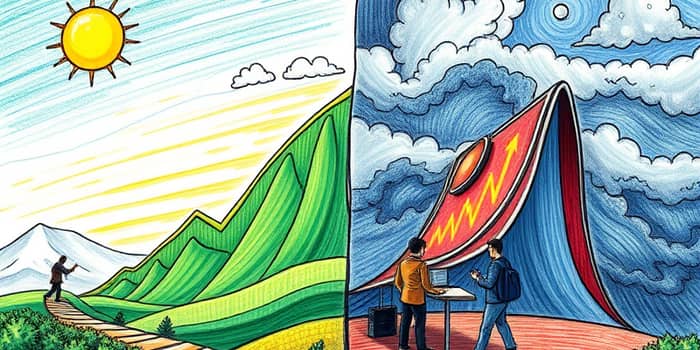

Financial markets move in waves, echoing the changing seasons of nature. By recognizing these recurring patterns, investors can prepare, adapt, and thrive through each turn. This article explores the anatomy of market cycles and offers actionable insights to build resilient portfolios.

Markets typically traverse four major stages: accumulation, markup, distribution, and markdown. Though durations vary, their characteristics remain distinct and predictable.

Understanding how different participants act in each phase helps anticipate market shifts and adjust strategies accordingly.

Adopting phase-appropriate tactics can enhance returns and limit risk. It’s crucial to avoid falling into market timing pitfalls by sticking to a plan and monitoring key indicators.

Sectors outperform at different cycle stages. Early and mid-cycle, technology, consumer cyclicals, and industrials often lead as corporate earnings recover and economic activity accelerates. As the cycle matures and inflationary pressures arise, energy and utilities gain favor due to stable cash flows and yield. In downturns, defensive areas—healthcare, consumer staples, and short-duration bonds—provide capital preservation.

By diversify across sectors and asset classes, investors can smooth returns and capture opportunities when the market transitions phases unexpectedly.

Detecting where the market stands requires a blend of technical, fundamental, and sentiment analysis. No single indicator suffices, but combining multiple tools sharpens accuracy.

Recognizing the current phase empowers you to adjust risk profiles and stay calm during volatility. Adopting a maintaining a long-term disciplined approach ensures you don’t abandon sound strategies under pressure.

Key risk-management practices include dollar-cost averaging to smooth entry prices, rebalancing to lock in gains and reset exposures, and using stop-loss orders or hedges when necessary. These measures help in mitigating volatility across cycles and protect against severe drawdowns.

Additionally, embracing a mindset that markets fluctuate—akin to navigating constant global economic uncertainty—fosters patience and resilience. View downturns not as disasters but as resets that precede the next opportunity to accumulate quality assets.

Market cycles are inevitable and unpredictable in exact timing, but their broad contours remain consistent. By studying historical patterns, staying vigilant for key signals, and deploying phase-appropriate strategies, you can position your portfolio to benefit over the full cycle.

Remember to embrace each market phase with confidence rather than fear, stay diversified, and remain anchored to your long-term objectives. Through careful preparation and disciplined action, both ups and downs become stepping stones toward lasting financial success.

References