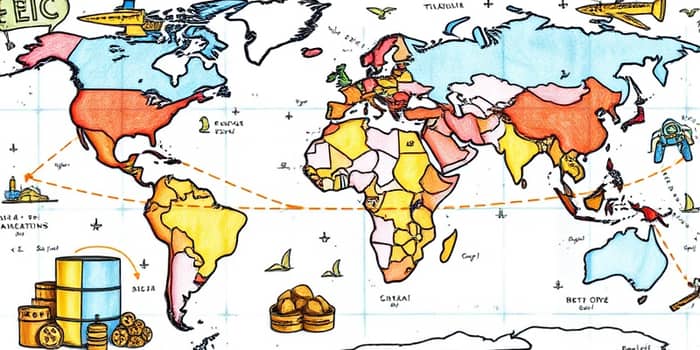

Global trade policies shape the economic landscape in profound ways, influencing both tangible commodities and the currencies that facilitate their exchange. Understanding these mechanisms empowers businesses, investors, and policymakers to navigate uncertainty and seize opportunities.

Global trade policies encompass a wide array of tools such as tariffs, trade agreements, sanctions, and environmental regulations. They govern how goods and services cross borders, directly affecting production costs, supply chains, and consumer prices.

When a government adjusts its trade stance, it sets in motion global supply and demand dynamics that ripple through markets. These shifts often trigger volatility in commodity prices and currency valuations, creating both risks and rewards for stakeholders.

Commodity markets respond swiftly to adjustments in trade policy. Government measures can either stabilize prices or provoke rapid swings, depending on their nature and scope.

The U.S.-China tariff standoff provides a telling example. When the U.S. imposed duties on Chinese steel and aluminum, global prices for these metals spiked, affecting downstream industries from automotive to construction. Simultaneously, exporters in non-targeted countries capitalized on redirected demand.

Similarly, sanctions on oil-producing nations have historically curtailed supply, contributing to price surges. In response, buyers diversify imports, seeking stability in emerging markets—a dynamic that further complicates supply chains.

Currency values are intimately tied to trade flows. When policies alter the cost or feasibility of imports and exports, exchange rates often adjust to balance the new equilibrium.

For instance, during periods of heightened trade tension, investors often flock to safe-haven currencies like the U.S. dollar or Swiss franc, amplifying their value. Conversely, an emerging market that negotiates a favorable trade agreement may see its currency appreciate as confidence grows.

Central banks play a crucial role in this interplay. A tightening monetary policy in response to tariff-induced inflation can strengthen a currency, but it may also slow economic growth, illustrating the delicate balance between domestic objectives and global market reactions.

Looking ahead, trade policy will continue to evolve under the pressure of environmental concerns, digital transformation, and shifting geopolitical alliances. Markets will respond to these drivers, creating fresh opportunities and challenges.

As stakeholders assess upcoming policy shifts, they must weigh the interplay between environmental objectives and economic imperatives. Renewable energy standards, carbon tariffs, and circular economy initiatives will all leave their mark on commodity supply chains and currency markets.

Ultimately, adaptability and informed decision-making are paramount. By tracking policy announcements, analyzing statistical projections, and maintaining diversified portfolios, businesses and investors can turn market fluctuations into strategic advantages.

In a world where trade policies can reshape entire economies overnight, staying informed and agile is the key to thriving amid uncertainty.

References