In a world where headlines scream about market highs and lows, investors often feel overwhelmed by the pressure to pick the perfect moment to buy. Dollar-cost averaging transforms this uncertainty into an opportunity, offering a clear path to build wealth steadily. Rather than chasing timing, you commit to investing a fixed amount at regular intervals, harnessing market fluctuations in your favor.

This article explores every facet of DCA: how it works, why it matters, and how you can implement it today to foster long-term financial security.

At its core, dollar-cost averaging involves investing a set dollar amount—say $1,000—at consistent intervals, irrespective of price movements. This approach is sometimes called a constant dollar plan. When prices dip, your money buys more shares; when prices rise, you acquire fewer. Over time, these purchases average out to a price that can be lower than a single lump-sum investment made at the wrong moment.

Many investors already use DCA without realizing it, thanks to automatic 401(k) or retirement plan contributions deducted each paycheck. This built-in discipline is one of DCA’s greatest strengths.

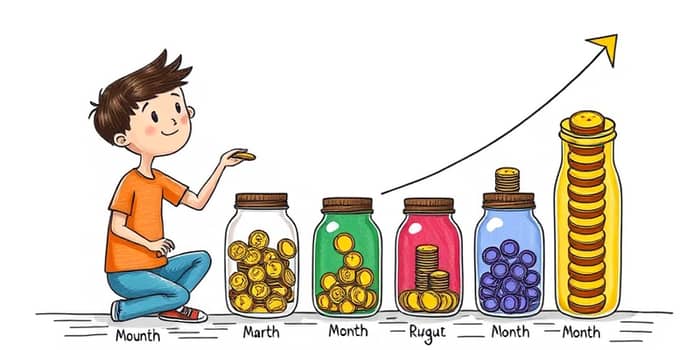

Imagine you commit to investing $1,000 on the 15th of every month in a stock or ETF. Your purchases might look like this:

After five months, you have invested $5,000 and own 253.43 shares at an average cost of $19.73, compared to the 250 shares you would have at $20 if you had invested all at once. Over many intervals, this smoothing effect can reduce the impact of short-term volatility and help you avoid buying exclusively at peaks.

By focusing on a steady investment plan instead of chasing hot tips, DCA helps investors stay the course, even during turbulent markets.

Investors often weigh DCA against lump-sum investing. While research shows that deploying a one-time investment in a strictly rising market typically yields higher returns, DCA offers a buffer against unexpected downturns and eases psychological stress.

Key distinctions include:

Academic studies reinforce DCA’s value. A 30-year S&P 500 analysis revealed that DCA returned 254%, outperforming several market-timing strategies (227%–252%). Only a hypothetical “perfect foresight” approach, impossible in reality, surpassed it with 289% gains.

Galaxy Asset Management extended the analysis to 2007–2024, comparing DCA against “buy the dip” tactics in both cryptocurrencies and S&P 500 funds. DCA not only delivered smoother returns but also reduced drawdowns during intense volatility.

Humans are not perfectly rational. Fear, greed, and regret often drive buy and sell decisions, leading to costly mistakes. By automating investments on a schedule, DCA eliminates much of this emotional interference. Investors can avoid the paralysis of waiting for the “perfect” moment and sidestep the anxiety of large, poorly timed purchases.

DCA is less suited to fixed-income instruments like bonds or CDs, where price movements are minimal and interest is predictable.

For investors seeking to enhance returns, variations like value averaging adjust contribution amounts based on price movements: invest more when prices fall and less when they rise. Others combine a core DCA plan with opportunistic lump-sum additions during sharp market corrections, blending caution with agility.

Dollar-cost averaging is not a panacea. In a relentlessly rising market, part of your capital sits idle longer, missing early gains. Additionally, frequent transactions in accounts with high per-trade fees can shrink returns. Finally, DCA does not immunize against prolonged bear markets, though it limits exposure during sudden downturns.

By automating your contributions, you remove the burden of manual execution and reinforce the habit of investing, regardless of market headlines.

Dollar-cost averaging is a time-tested approach that balances risk and reward. It empowers investors to:

Whether you’re saving for retirement, a major purchase, or a long-term goal, DCA offers a proven framework for building wealth one step at a time. Start small, stay consistent, and let the power of compound growth and market fluctuations work in your favor.

References